Preston

NI 43-101 Technical Report - Preston

Preston Uranium Project Highlights:

-

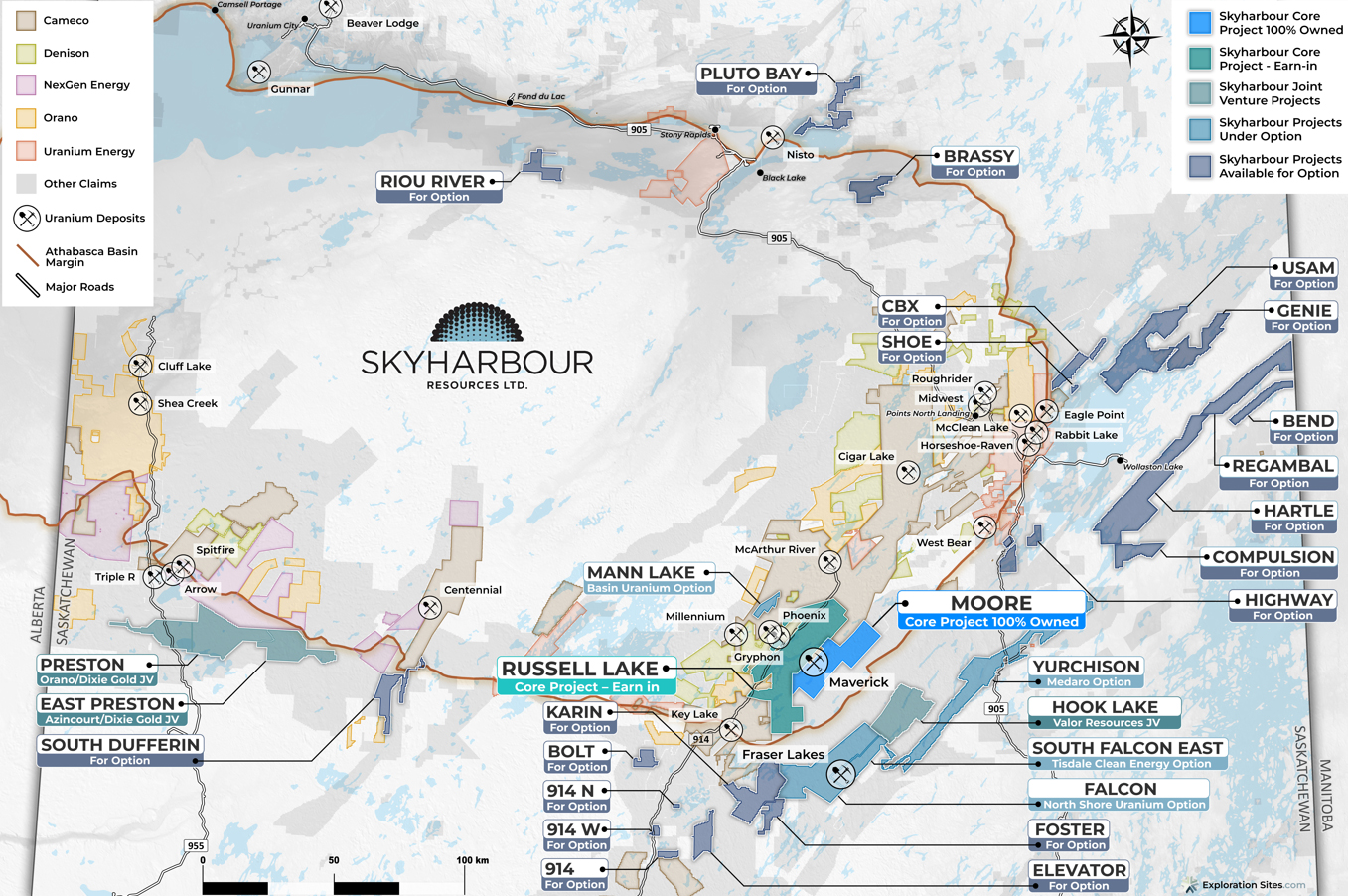

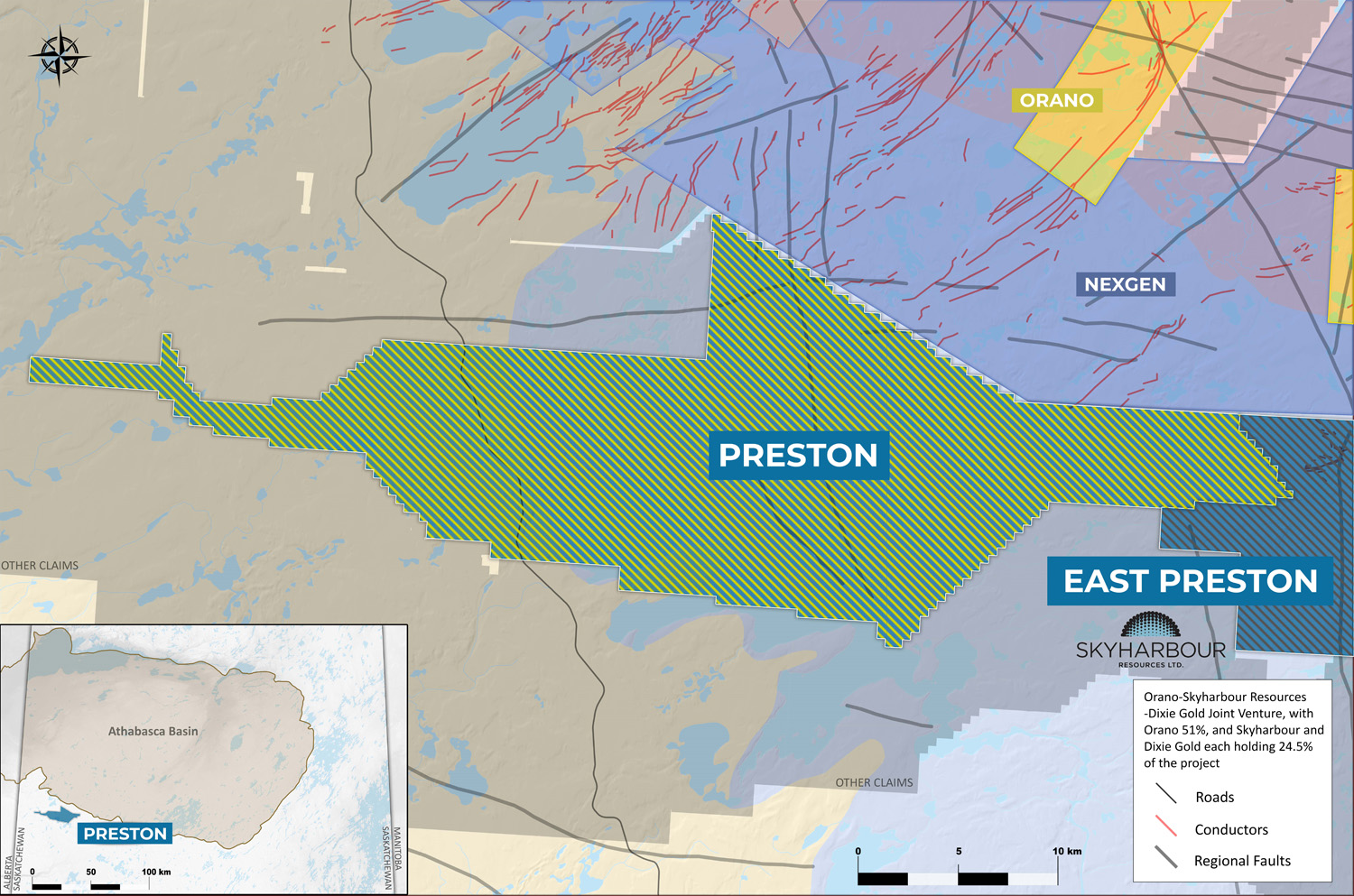

Large 49,635 hectare (122,651 acre) land position strategically located to the south of and adjacent to NexGen Energy's (TSX: NXE) Rook 1 project host to the high grade Arrow deposit, as well as proximal to Fission Uranium’s (TSX: FCU) Patterson Lake South (“PLS”) project host to the high grade Triple R deposit

-

The Preston Uranium Property is bisected by the all-weather Highway 955, which runs north through the PLS Project being advanced by Fission through to the former Cluff Lake uranium mine

-

March 2017, Skyharbour signed an option agreement with industry-leader and strategic partner Orano (formerly AREVA) Resources Canada to option a majority stake in the Preston Project

-

Orano has fulfilled their first earn-in option interest for 51% in the project by completing CAD $2.8 million in staged exploration expenditures and making a total of CAD $200,000 in cash payments divided evenly between Skyharbour and Dixie Gold

-

Following the acquisition of the interest, Orano has formed a joint venture with Skyharbour and Dixie Gold for the future advancement and development of the Project. Orano now holds a 51% (fifty-one percent) interest in the joint venture, with the remaining interest split evenly between Skyharbour and Dixie Gold with each company retaining a 24.5% interest in the joint venture

-

Historical exploration at the project has consisted of ground gravity, airborne and ground electromagnetics, radon, soil, silt, biogeochem, lake sediment, and geological mapping surveys, as well as several exploratory drill programs

-

Numerous high-priority drill target areas associated with multiple prospective exploration corridors have been successfully delineated through this methodical, multiphased exploration initiative, which has culminated in an extensive, proprietary geological database for the project area

-

Given the size of the property, exploration to date has only focused on approx. 50% the land package leaving significant exploration upside potential in untested areas

Preston Uranium Project Summary:

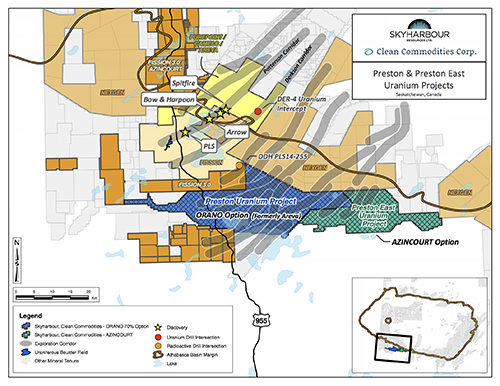

The Preston Uranium Property is bisected by the all-weather Highway 955, which runs north through the PLS Project being advanced by Fission through to the former Cluff Lake uranium mine. This part of the Preston Lake Property is on strike with the W-SW to E-NE mineralized trend being delineated by Fission Uranium at the nearby PLS project. The claims are underlain by Phanerozoic rocks (limestone and sandstone) similar to the PLS discovery area where it is interpreted that the uranium has been mobilized along the fault zones and has been concentrated in the sandstone under the limestone. Beneath the Phanerozoic cover rocks, some parts of the property are transected by the margin of the Clearwater and Lloyd Domains. Although the significance of this contact is poorly understood it may be important given the similar tectonic/structural settings present at the nearby Cluff Lake, Shea Creek and PLS high-grade uranium discoveries.

Exploration to date has consisted of ground gravity, airborne and ground electromagnetics, radon, soil, silt, biogeochem, lake sediment, and geological mapping surveys, as well as several exploratory drill programs. Numerous high-priority drill target areas associated with multiple prospective exploration corridors have been successfully delineated through this methodical, multiphased exploration initiative, which has culminated in an extensive, proprietary geological database for the project area.

2024 Field Programs:

Orano recently commenced a comprehensive 2024 field campaign at the Preston Uranium Project, marking the first exploration programs carried out by Orano since 2020. The program will include a ground electromagnetic survey (ML-TEM), a ground gravity survey, and a Spatiotemporal Geochemical Hydrocarbons (SGH) soil sampling program.

The geophysics will consist of ground Moving-Loop Transient ElectroMagnetic (ML-TEM) and ground gravity surveys for an estimated 35.6 line-km and 2,295 stations, respectively. The ML-TEM survey will cover Preston West where there is a known conductor, and Preston Far West as a reconnaissance survey. The gravity survey will cover an area with intentions to identify alteration zones manifesting as gravity lows. The SHG soil sampling is set to commence later in the summer with additional news forthcoming.

Joint-Venture with Strategic Partner Orano (formerly AREVA):

Orano has fulfilled their first earn-in option interest in the project by completing CAD $2.8 million in staged exploration expenditures and making a total of CAD $200,000 in cash payments over the previous three years, divided evenly between Skyharbour and Dixie Gold. A total of CAD $4.8 million has been spent on the Project to date.

Following the acquisition of the interest, Orano has formed a joint venture with Skyharbour and Dixie Gold for the future advancement and development of the Project. Orano now holds a 51% (fifty-one percent) interest in the joint venture, with the remaining interest split evenly between Skyharbour and Dixie Gold with each company retaining a 24.5% (twenty-four and a half percent) interest in the joint venture.

Headquartered in Saskatoon, Saskatchewan, Orano Canada Inc. is a leading producer of uranium, accounting for the processing of 18 million pounds of uranium concentrate produced in Canada in 2022. Orano Canada has been exploring for uranium, mining and milling in Canada for more than 55 years. Orano Canada is the operator of the McClean Lake uranium mill and a major partner in the Cigar Lake (40.453%), McArthur River (30.2%) and Key Lake (16.7%) operations. The McClean Lake joint venture is owned by Orano Canada (77.5%) and Denison Mines (22.5%). Orano toll mills the ore from the Cigar Lake mine at the McClean Lake mill.

The company employs about 420 people in Saskatchewan, including about 300 at the McClean Lake operation where over 49% of employees are self-declared Indigenous. As a sustainable uranium producer, Orano Canada is committed to safety, environmental protection and contributing to the prosperity and well-being of neighbouring communities.

Orano Canada Inc. is a 100% subsidiary of Orano Mining, part of the multinational Orano group. As a recognized international operator in the field of nuclear materials, Orano delivers solutions to address present and future global energy and health challenges. Its expertise and mastery of cutting-edge technologies enable Orano to offer its customers high value-added products and services throughout the entire fuel cycle. With uranium mines in operation in Canada, Kazakhstan and Niger, Orano is one of the world’s leading producers of uranium, with competitive production costs and extraction techniques at the cutting edge of innovation. Every day, the Orano group’s 17,000 employees draw on their skills, unwavering dedication to safety and constant quest for innovation, with the commitment to develop know-how in the transformation and control of nuclear materials, for the climate and for a healthy and resource-efficient world, now and tomorrow.

Patterson Lake Area Discoveries (Southwest Athabasca Basin, Saskatchewan):

Patterson Lake Area Exploration Corridors

Click to Enlarge

- The Arrow discovery made by NexGen Energy (TSX: NXE); now the high grade Arrow deposit

- Patterson Lake South discovery made by Fission Uranium (TSX: FCU); now the high grade Triple R deposit

- The PLN discovery made by F3 Uranium Corp. (TSX-V: FUU); high grade JR Zone

- Three separate major discoveries in this emerging uranium district illustrates the high grade nature of mineralization and potential for additional discoveries

The significant potential of the Project has been highlighted by past discoveries in the area by NexGen Energy Ltd. (Arrow deposit), Fission Uranium Corp. (Triple R deposit), and F3 Uranium Corp. (PLN discovery).

Exploration Programs Conducted by Orano in 2017-2020:

In the spring of 2017, a Quaternary evaluation of the Preston property was performed by Orano Resources followed by a two week summer field program which included the review of historical drill holes, outcrop visits, sampling and general prospecting and surveying. Orano then completed ground EM surveys within the Dixon Lake target area and a more exhaustive review of the project historical information.

In the fall of 2017, Moving Loop Transient Electromagnetic (ML-TEM) surveys were completed on two grids located east of highway 955. The Johnson Lake Corridor (JLC) hosts two main north-northeast and northeast trending VTEM conductive trends. Numerous areas of interest have been identified along the VTEM conductive zones and of particular interest at this time is the area northeast of Canoe Lake which hosts radon-in-water anomalies

The Dixon Lake Corridor (DLC) comprises two VTEM conductive trends dominantly oriented northeast-southwest. The FS target area located on the northeast edge of these VTEM trends is considered an area of interest and ground geophysical surveys, including the Max-Min method, were performed to define drill targets. The Max-Min survey identified three discrete conductors within a wide, approximately 800m, VTEM conductive area. Three historical holes drilled within the FS area tested one of the conductors and two holes, PN15004 and PN15005, encountered locally sheared graphitic and pyritic semi-pelite, whereas hole PN14009 was lost at 150m within a clay gouge. The intersected graphite confirmed the east-west trending conductor.

Line-cutting work in preparation for two ML-TEM surveys is currently underway with one survey to be carried out on the JL grid and a second one on the FS grid. The JL grid comprises seven profiles for survey coverage of 28.5 line-kilometers while the FS grid consists of three profiles for survey coverage of 3.6 km. AREVA Resources’ ML-TEM survey on the FS area will investigate the extent of the conductor located near anomalous radioactivity found on a large granitic gneiss outcrop. Moderate to strong silicification and north-south trending narrow dark shear bands were noted on the outcrop.

In the winter of 2018, Orano conducted a diamond drilling program consisting of approximately 4,500 metres. Drilling focused on areas of interest defined by ground EM surveys within the west part of the project, east of highway 955 and the FS areas. Orano followed this program up with a 2019 winter diamond drilling program consisting of approximately 3,600 metres on the Preston Project. Drilling tested targets defined by the 2018 EM surveys on the JL and FSA target grids. These diamond drilling programs on the property intersected numerous and extensive, well developed and commonly graphitic ductile shear zones, that were clearly reactivated over time. These structures correlate with elongated NNE-trending magnetic lineaments. A later brittle event is common in both drill core and the magnetic data and could provide a locus for mineralizing fluids. The shear zones are also commonly altered and locally metal enriched (pyrite-pyrrhotite-chalcopyrite). The basement rocks intersected are complexly deformed supracrustal rocks; largely graphitic orthogneiss with minor paragneiss, intruded by Archean granitoids. These lithologies are common to the proven uranium mineralization in the Western Athabasca region (Shea Creek and Patterson Lake corridor deposits). Of note, is that unlike the deposit areas the Preston Lake property has seen little historical drill testing.

In the winter of 2020, Orano’s exploration program on the Preston Project consisted of DC resistivity ground geophysics on the JL and Canoe grids and the B conductive area. To date exploration on the Preston project has consisted of a traditional approach of defining conductors via ground EM surveys and diamond drilling. The objective of the exploration program was to use the DC resistivity method to further characterize the EM conductors by providing information about possible clay, silicification or associated alteration in the vicinity of conductors adding another layer of information to prioritize areas to be drill tested.

Historical Exploration in the Preston Region:

An initial review of historic exploration data on the Preston Uranium Property has identified a number of potential areas for follow up. One high-priority area has clusters of anomalous uranium in lake sediment samples, anomalous uranium values in rock samples (up to 5.6 ppm U), and the presence of kilometre-scale northeast-southwest trending graphitic faults associated with sulphides and anomalous radioactivity as identified with scintillometers. A review of historic data has also identified a significant uranium in lake sediment anomaly in the western part of the Preston Uranium Property. A sample collected by the Geological Survey of Canada returned a value of 4.8 ppm U, considered to be significant in an area with a background uranium value of 1 ppm U. This high uranium value may indicate either the down-ice glacial transport of uranium boulders from source or an in-situ source of uranium. For comparison, the highest value down-ice from the Patterson Lake South discovery is 3.8 ppm U. Management cautions that past results or discoveries on proximate land are not necessarily indicative of the results that may be achieved on these properties.

Uranium mineralization in the Patterson Lake area bears a number of similarities to the high-grade uranium deposits in the Eastern part of the Athabasca Basin like those at the Cigar Lake and McArthur River mines. The mineralization occurs in structurally disrupted and strongly clay altered, commonly graphitic pelites and metapelites with narrow felsic segregations / pegmatites. Intervals of quartz-feldspar gneiss and semipelite are also present. Sulphides are commonly associated with the mineralization along with anomalous levels of cobalt, nickel, molybdenum and boron. Uranium mineralization in the Patterson Lake area is also associated with felsic intrusives, primarily pegmatites. Skyharbour has both target types on its pre-existing properties and its recently acquired land in the Patterson Lake region.

Skyharbour and Western Athabasca Syndicate's Exploration Programs 2014-2015