How It Works

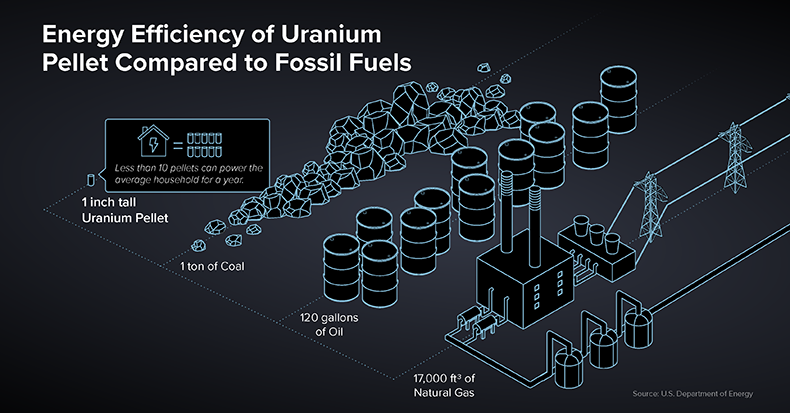

Uranium is a naturally-occurring element in the Earth's crust. Traces of it occur almost everywhere, although mining takes place in locations where it is naturally concentrated. To make nuclear fuel from the uranium ore requires first for the uranium to be extracted from the rock in which it is found, then enriched in the uranium-235 isotope, before being made into pellets that are loaded into assemblies of nuclear fuel rods. These fuel rods are then grouped together to form fuel assemblies, which make up the core of a reactor. In the reactor core the uranium-235 isotope fissions or splits, producing a lot of heat in a continuous process called a chain reaction. At a nuclear power plant, the heat from fission is used to produce steam, which spins a turbine to generate electricity. (Source: World Nuclear Association)

Uranium: Global Energy Source

Nuclear power and hydropower form the backbone of low-carbon electricity generation. Together, they provide three-quarters of global low-carbon generation. Over the past 50 years, the use of nuclear power has reduced CO2 emissions by over 60 gigatonnes – nearly two years’ worth of global energy-related emissions. Global demand for electricity is set to grow 50% by 2040 and nuclear energy will play an integral role in meeting this demand. The WNA reports that there are 438 nuclear reactors operable in over 32 countries. These reactors can generate approx. 400 gigawatts of electricity and supply approx. 10% of the world's electrical requirements. There are 72 nuclear reactors under construction in 15 countries with the principal drivers of this expansion being China (30 reactors under construction), the Middle East, Russia and India. Furthermore, the WNA reports that there are over 400 reactors that are either ordered, planned or proposed.

In the World Energy Outlook 2025 by the International Energy Agency (IEA), global nuclear generating capacity is projected to grow significantly under current and stated policies. In particular, installed nuclear capacity is expected to increase from about 420 GWe in 2024 to around 728 GWe by 2050 under a scenario based on existing energy policies, driven by new builds, extended lifetimes of existing plants, and stronger policy support, representing at least a one-third increase over current levels.

UxC continues to project that uncovered uranium requirements will rise sharply, with about 2.1 billion lbs of contracting needed by 2040. UxC and other industry forecasts also suggest that annual uranium demand could exceed 300 million pounds U₃O₈ by the 2030s, up from just under 200 million pounds today. Meanwhile, primary mine supply for 2026 is forecast at ~175 million pounds U₃O₈, up from earlier estimates of ~155 million lbs.

WNA’s Reference Scenario for Uranium Supply & Demand

Uranium Market Commentary and Update:

The uranium market is experiencing its most robust fundamentals in over a decade, with structural supply deficits, rising geopolitical pressures, and accelerating demand all supporting a long-term bullish outlook. Following years of underinvestment due to historically low prices, the uranium supply side remains constrained.

The uranium market remains highly vulnerable due to extreme geographic concentration, with Kazakhstan, Canada, and Namibia among the dominant primary producers. In 2025 and 2026, supply has been further constrained by production guidance cuts at major producers: Kazatomprom announced a roughly 10 % reduction in its 2026 production target, lowering expected output by about 8 million pounds of U₃O₈ (around 5 % of global primary supply) relative to prior targets, and Cameco revised its McArthur River/Key Lake 2025 guidance down to 14 - 15 million pounds from an earlier ~18 million pound target. Cameco’s 2026 production guidance calls for 19.5 to 21.5 million pounds of U3O8 on an attributable basis, reflecting a disciplined production strategy aligned with long-term contract commitments and continued market tightness as global demand grows.

Years of curtailed production—exacerbated by the pandemic—have left the market structurally undersupplied. Even as prices have rebounded, many producers remain cautious about ramping up, prioritizing disciplined growth over volume.

Russia’s invasion of Ukraine continues to reshape global energy strategies. In May 2024, the U.S. passed the Prohibiting Russian Uranium Imports Act, banning imports of low-enriched uranium (LEU) from Russia starting August 2024. This move will remain in effect until 2040 and aims to reduce dependence on Russian nuclear fuel. The ban is expected to create incremental demand for uranium from North American and allied producers, while accelerating investment in domestic enrichment and conversion capacity.

On the demand side, the recovery has been even more dramatic. Global uranium demand has now exceeded pre-Fukushima levels and continues to grow, fueled by both traditional large reactors and new small modular reactors (SMRs). Primary mine production in 2026 is forecast at approximately 175 million pounds of U₃O₈, while global demand is projected to exceed 200 million pounds, according to UxC and industry estimates. This creates a significant annual shortfall, with the cumulative supply gap expected to surpass 300 million pounds by the early 2030s.

Key drivers of this growth include:

-

Over 50% of utility contracts expiring by 2027, prompting an expected wave of long-term contracting activity.

-

The rising deployment of SMRs, which are now forecast to represent up to 5% of global nuclear capacity by 2040.

-

The commitment by 33 countries to triple nuclear capacity by 2050, as announced at COP30.

-

EU Taxonomy inclusion of nuclear as a sustainable investment, facilitating institutional capital flows.

-

President Trump has signed executive orders aiming to quadruple U.S. nuclear energy capacity from 100 GW to 400 GW by 2050, positioning the nation as a global leader in nuclear power. President Trump has signed executive orders aiming to quadruple U.S. nuclear energy capacity from 100 GW to 400 GW by 2050, positioning the nation as a global leader in nuclear power.

Adding to this momentum is interest from non-traditional players. Major technology firms are increasingly exploring dedicated nuclear power sources to supply their data centers and AI infrastructure, which require clean, uninterrupted baseload power.

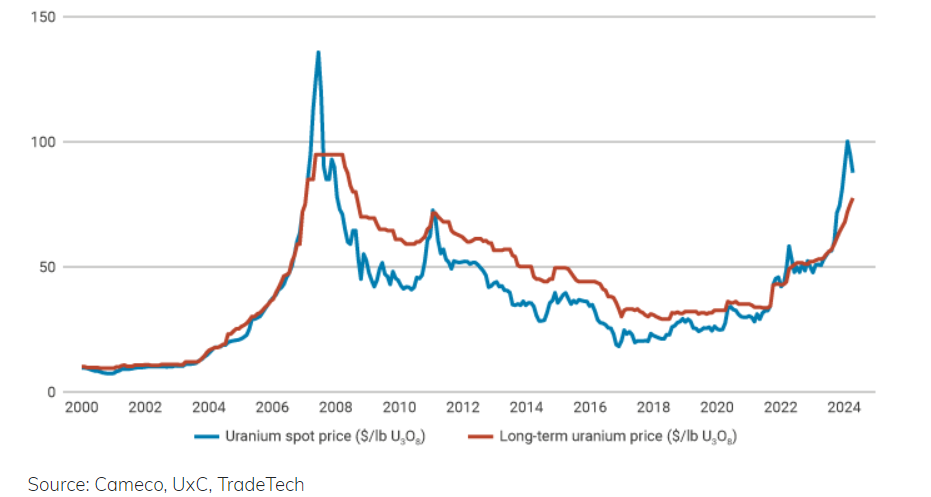

Uranium prices have responded accordingly, with spot prices now trading around $90/lb in 2026—still up significantly from the $40–50 range just a few years ago. However, producers remain reluctant to sign long-term contracts near current market prices, tightening the available supply of material and giving utilities few options but to bid more aggressively in the term market, where prices remain firm at about $88/lb.

In short, all signs point to a prolonged uranium bull market:

-

Persistent supply deficits,

-

Renewed long-term contracting,

-

Strong policy tailwinds, and

-

A broadening base of demand.

Nuclear energy remains the only scalable, emissions-free baseload power source available today. With governments, utilities, and now tech giants recognizing this reality, uranium is increasingly viewed not just as a strategic commodity—but as a cornerstone of the global energy transition.

Uranium: Prices

Uranium is primarily acquired by nuclear utilities through long-term contracts, which typically begin deliveries two to four years after signing and span delivery periods of four to ten years. These contracts are structured to provide supply security and predictability for both utilities and producers.

Contracts often include flexible provisions such as annual volume options, floor and ceiling prices, and delivery scheduling clauses. While the specific pricing terms are usually confidential, market indicators suggest that current long-term prices have risen alongside spot prices due to tightening supply.

A key driver of long-term contracting activity is uncovered utility demand—the portion of future nuclear fuel needs not yet secured under contract. According to UxC, uncovered demand is expected to grow sharply through 2030, with over 50% of global utility contracts set to expire by 2027. As a result, many utilities are now returning to the market to secure future supply, often facing limited availability and higher prices from producers reluctant to contract near current market levels.

In early 2026, the uranium spot price has stabilized around $83 per pound, underpinned by robust demand, declining secondary supplies, and long-term supply deficits. Long-term pricing is following suit, with multi-year contracts now being negotiated at materially higher levels than seen in the past decade.

This market environment signals a fundamental shift from the previous era of oversupply and suppressed prices, to one increasingly defined by contracting discipline, supply security, and growing recognition of uranium’s strategic role in the global energy transition.

Spot and Long-Term Uranium Prices (2000-2023)

Uranium: Value of Grades

| Metal | Grade | lbs/t | $/unit | Value/t |

| U3O8 | 1% | 22 | $87 /lb | $1,914 |

| Gold | 11.7 g/t | - | $5,070 /oz | $1,914 |

| Silver | 730.5 g/t | - | $81.5 /oz | $1,914 |

| Copper | 15% | 330 | $5.8 /lb | $1,914 |

| Zinc | 58% | 1,276 | $1.5 /lb | $1,914 |

| 1% U3O8 (Uranium) = | 11.7 g/t Gold | |||

| 730.5 g/t Silver | ||||

| 15% Copper | ||||

| 58% Zinc | ||||

Scroll right to view more

Scroll right to view more

Scroll right to view more

Scroll right to view more

Scroll right to view more

Scroll right to view more

Scroll right to view more

Scroll right to view more

Scroll right to view more

Scroll right to view more

Scroll right to view more

Scroll right to view more

Scroll right to view more

* Calculated in US $ using metric tonnes and troy ounces in March 2026

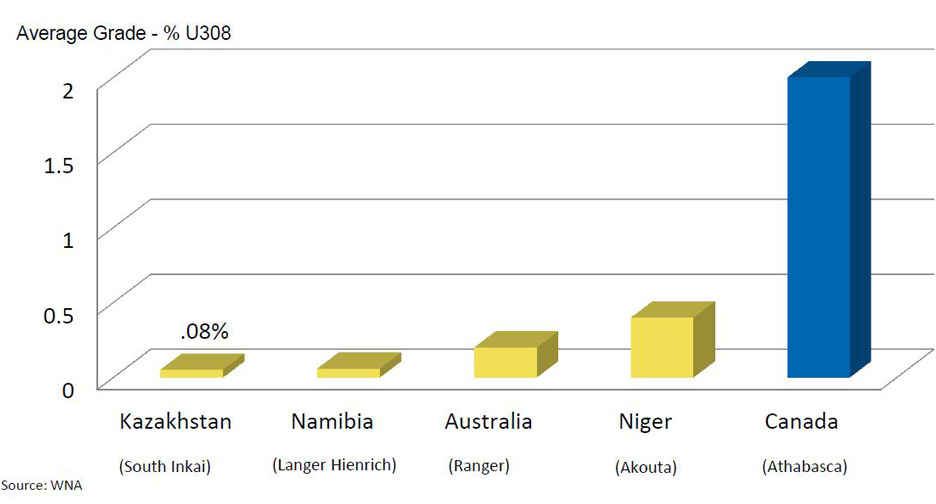

Uranium: Exploration in the Athabasca Basin, Northern Saskatchewan

The uranium (U3O8) deposits of Saskatchewan, Canada are the richest in the world. The Athabasca Basin is an ancient sedimentary basin which hosts the world's most significant uranium mines and produces almost 20% of the current world uranium production in a safe and favourable jurisdiction. Athabasca uranium deposits also have grades substantially higher than the world average grade of under 0.2% U3O8.

Average Grade per Region

Why The Athabasca Basin?

The Athabasca Basin is home to the world’s largest and highest grade uranium mining and milling operations – including the McArthur River and Cigar Lake uranium mines, as well as the Key Lake and McClean Lake uranium mills. Saskatchewan is also consistently ranked as a top mining jurisdiction to work in globally by the Fraser Institute. Skyharbour holds an extensive portfolio of uranium exploration projects in the Basin and is well positioned to benefit from improving uranium market fundamentals with 43 projects. Skyharbour has acquired from Denison Mines, a large strategic shareholder of the Company, a 100% interest in the Moore Uranium Project which is located 15 kilometres east of Denison's Wheeler River project and 39 kilometres south of Cameco's McArthur River uranium mine.

2012-2022 Southwest Athabasca Basin Uranium Discoveries

- The Arrow discovery made by NexGen Energy (TSX: NXE); now the high grade Arrow deposit

- Patterson Lake South discovery made by Fission Uranium (TSX: FCU); now the high grade Triple R deposit

- Cameco / Orano (formerly AREVA) / Purepoint Uranium's Hook Lake Spitfire Zone high grade discovery

- Three separate major discoveries in a short period of time in this emerging uranium district illustrate high grade nature of mineralization and potential for additional discoveries

- The JR Zone was recently discovered by F3 Uranium (TSX.V: FUU) during a fall 2022 drilling program on the Patterson Lake North "PLN" property

- CanAlaska announced the discovery of the Pike Zone at the West McArthur project, located approximately 20 kilometers west of Cameco's McArthur River mine

2005-2021 Eastern Flank Athabasca Basin Uranium Discoveries

- Wheeler River's Phoenix and Gryphon Deposits being explored and developed by Denison Mines (TSX: DML); Phoenix deposit contains indicated resources of 70.2M lbs U3O8 at a grade of 19.1% U3O8 and the Gryphon deposit 3 kilometres northwest of Phoenix contains inferred resources of 43M lbs U3O8 at a grade of 2.3% U3O8

- Hathor Exploration which was acquired by Rio Tinto in 2011 explored Roughrider deposit which contains indicated resource of 17.2M lbs U3O8 at a grade of 1.98% U3O8 and inferred resource of 40.7M lbs U3O8 at a grade of 11.2% U3O8

- J-Zone discovery by Fission Uranium and KEPCO; indicated 306,831 tonnes at 1.52% U3O8 (10.2 million lbs) and inferred 138,404 tonnes at 0.90% U3O8 (2.7 million lbs)

- Hurricane Zone high grade discovery 29.9% U3O8 over 7.0 metres in drill hole Q22-040 made by IsoEnergy (TSX-V: ISO) at their Larocque East property

- The majority of the large, high grade uranium deposits and mines are found on the east side of the Basin with the potential for additional discoveries to be made