Uranium Overview

How It Works

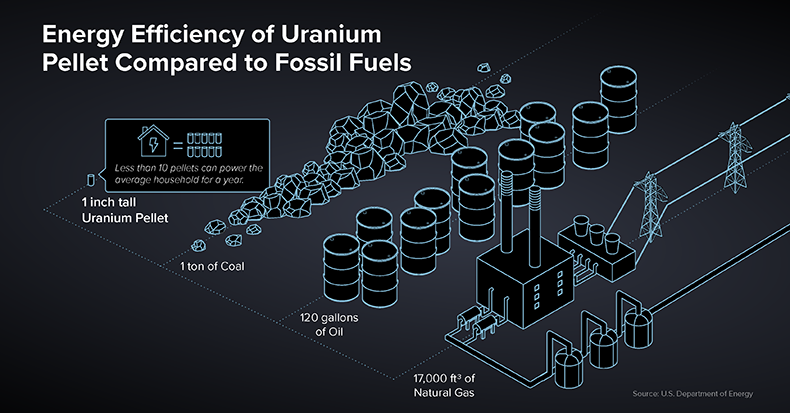

Uranium is a naturally-occurring element in the Earth's crust. Traces of it occur almost everywhere, although mining takes place in locations where it is naturally concentrated. To make nuclear fuel from the uranium ore requires first for the uranium to be extracted from the rock in which it is found, then enriched in the uranium-235 isotope, before being made into pellets that are loaded into assemblies of nuclear fuel rods. These fuel rods are then grouped together to form fuel assemblies, which make up the core of a reactor. In the reactor core the uranium-235 isotope fissions or splits, producing a lot of heat in a continuous process called a chain reaction. At a nuclear power plant, the heat from fission is used to produce steam, which spins a turbine to generate electricity. (Source: World Nuclear Association)

Uranium: Global Energy Source

Nuclear power and hydropower form the backbone of low-carbon electricity generation. Together, they provide three-quarters of global low-carbon generation. Over the past 50 years, the use of nuclear power has reduced CO2 emissions by over 60 gigatonnes – nearly two years’ worth of global energy-related emissions. Global demand for electricity is set to grow 50% by 2040 and nuclear energy will play an integral role in meeting this demand. The WNA reports that there are 439 nuclear reactors operable in over 32 countries. These reactors can generate approx. 400 gigawatts of electricity and supply approx. 10% of the world's electrical requirements. There are 61 nuclear reactors under construction in 15 countries with the principal drivers of this expansion being China (21 reactors under construction), the Middle East, Russia and India. Furthermore, the WNA reports that there are over 400 reactors that are either ordered, planned or proposed.

In the 2022 edition, the IEA's 'Stated Policies Scenario' sees installed nuclear capacity growth of over 43% from 2020 to 2050 (reaching about 590 GWe). UxC states that uncovered demand will rise rapidly over the coming years with 2.3 billion lbs of contracting needed by 2040, and UxC also estimates that annual uranium demand could grow nearly 65% to more than 300 million pounds U3O8 by 2030 from just under 200 million pounds U3O8 of demand today. The primary mine supply for 2024 is approx. 162 million pounds U3O8.

WNA’s Reference Scenario for Uranium Supply & Demand

(Click to Enlarge)

Uranium Market Commentary and Update:

The underlying supply-demand fundamentals for uranium are the strongest we have seen in a long time and dictate that a uranium price increase is needed. In the last few years we’ve seen a major supply side response play out with low uranium prices forcing production/supply curtailment which has been exacerbated by the pandemic. At one point, almost 50% of primary mine supply was offline as COVID 19 caused several operations to shut down temporarily. The uranium mining industry globally is reliant on supply highly concentrated both geologically and geographically and this makes the risks to the supply side far greater than the risks to the demand side. This has been seen recently with Russia's invasion of Ukraine, causing a crushing energy crises as Russia cut natural gas supplies, pushing some countries to delay plans to phase out nuclear energy and cut dependence on Russian nuclear fuels.

Before 2021, the world’s largest producers of uranium, Kazatomprom (the world’s largest producer headquartered in Kazakhstan) and Cameco (the second largest producer headquartered in Canada), scaled back operations and became buyers directly in the spot uranium market to make up for decreased production. At a price around $40-$50 per pound of U3O8, it is more profitable for them to buy in the spot market and sell into their higher priced contracts with nuclear utilities. However, Cameco announced the restart of its McArthur River and Key Lake operations in 2022, highlighting increased interest from contract buyers. Furthermore, much like we have seen leading up to previous uranium bull markets, there has been significant underinvestment in new mining projects which will further strain an already reduced supply side for years to come.

In 2024 there will be approximately 155 million pounds of primary mine supply in the backdrop of over 197 million pounds of uranium demand with a cumulative gap estimated to be over 300 million pounds by 2030. This supply deficit will surely help drive higher uranium prices going forward.

Shifting over to the demand side, the story has been improving, now exceeding pre-Fukushima levels, and has been outstripping primary supply over the past couple years. Finite inventories and other secondary supplies are being depleted to make up the difference. Furthermore, well over 50% of all utility uranium contracts require renewal before expiry in 2027. Utilities typically have a requirement to renew contracts 18-24 months before existing contracts expire, and therefore several utilities have recently come to the market with new RFP’s but uranium producers are unwilling to lock in long term contracts pricing their material close to the current uranium price.

Nuclear reactor demand for uranium is sticky and has been somewhat insulated to the COVID-19 pandemic versus other sources of electricity generation. It is still the only source of reliable, baseload, emissions-free electricity we have. The Reference Scenario of the 2023 edition of the World Nuclear Association's Nuclear Fuel Report has forecasted demand for uranium to nearly double by 2040. One of the key new contributors to this increase in demand was the Report’s inclusion of SMRs for the first time. The heightened uranium demand from SMRs is anticipated to manifest toward decade's end and intensify into the 2030s. The World Nuclear Association projects that SMRs might constitute up to 5% of the global nuclear capacity by 2040.

In addition to the current 439 operating reactors globally, demand is expected to increase on the back of new reactor construction in which there are currently 61 new nuclear reactors under construction. Demand is set to continue to grow, as governments aim to reduce emissions and focus on decarbonization and electrification. In recent news, the EU Taxonomy included nuclear as an environmentally sustainable investment, and we have seen leaders understanding that nuclear energy needs to play a larger role in order to move away from dependency on Russian oil and gas. In addition, there have been new financial entities like Yellow Cake and Sprott Physical Uranium Trust purchasing millions of lbs of uranium recently, which has put upward pressure on the price. The bottom line is that nuclear energy continues to have a positive outlook as an ideal source of clean, scalable, baseload, and affordable energy source.

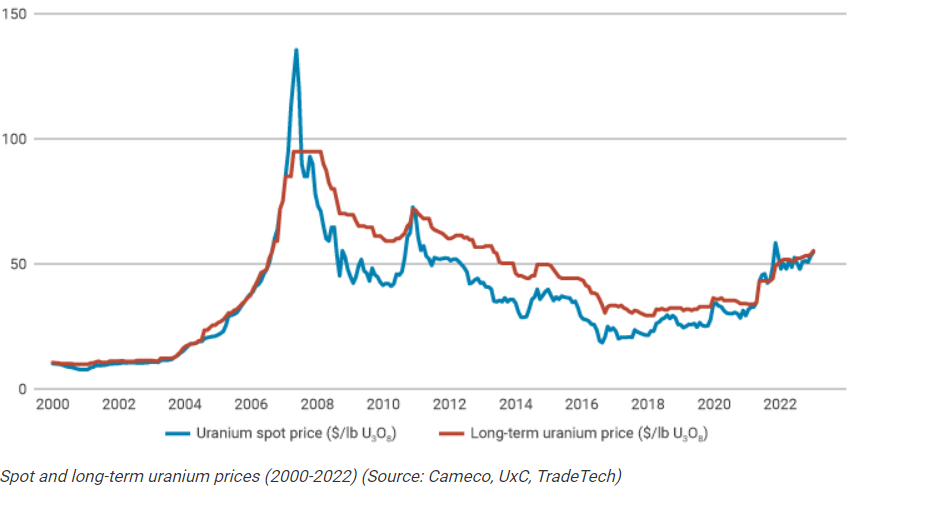

Uranium: Prices

Nuclear utilities purchase uranium primarily through long-term contracts. These contracts usually provide for deliveries to begin two to four years after they are signed and provide for delivery from four to ten years thereafter. In awarding medium and long-term contracts, electric utilities consider the producer's uranium reserves, record of performance and production cost profile, in addition to the commercial terms offered. Prices are established by a number of methods, including base prices adjusted by inflation indices, reference prices (generally spot price indicators, but also long-term reference prices) and annual price negotiations. Contracts may also contain annual volume flexibility, floor prices, ceiling prices and other negotiated provisions. Under these contracts, the actual price mechanisms are usually confidential.

The long-term demand that actually enters the market is affected in a large part by utilities' uncovered requirements. Uncovered demand is projected by UxC to increase significantly over the period of 2018 to 2030. In order to address the rising portion of demand that is uncovered, utilities will have to return to the market and enter into long-term contracts. Owners and operators of U.S. civilian nuclear power reactors (civilian owner/operators, or COOs) purchased a total of 40.5 million pounds U3O8e of deliveries from U.S. suppliers and foreign suppliers during 2022, at a weighted-average price of $39.08 per pound U3O8e. The 2022 total of 40.5 million pounds U3O8e was 13% lower than the 2021 total of 46.7 million pounds U3O8e. The 2022 weighted-average price of $39.08 per pound U3O8e was 15% higher than the 2021 weighted-average price of $33.91 per pound U3O8e and the highest price since 2016. (source: eia.gov). This illustrates the increased demand we are seeing that will ultimately result in a higher spot price.

Spot and Long Term Uranium Prices (2000-2022)

Uranium: Value of Grades

| Metal | Grade | lbs/t | $/unit | Value/t |

| U3O8 | 1% | 22 | $88 /lb | $1,936 |

| Gold | 28.35 g/t | - | $2,350 /oz | $1,936 |

| Silver | 1,898 g/t | - | $29 /oz | $1,936 |

| Copper | 20.5% | 450.2 | $4.3 /lb | $1,936 |

| Zinc | 73.3% | 1,613.3 | $1.2 /lb | $1,936 |

| 1% U3O8 (Uranium) = | 28.35 g/t Gold | |||

| 1,898 g/t Silver | ||||

| 20.5 % Copper | ||||

| 73.3 % Zinc | ||||

* Calculated in US $ using metric tonnes and troy ounces in April 2024

Uranium: Exploration in the Athabasca Basin, Northern Saskatchewan

The uranium (U3O8) deposits of Saskatchewan, Canada are the richest in the world. The Athabasca Basin is an ancient sedimentary basin which hosts the world's most significant uranium mines and produces almost 20% of the current world uranium production in a safe and favourable jurisdiction. Athabasca uranium deposits also have grades substantially higher than the world average grade of under 0.2% U3O8.

Average Grade per Region

Click to Enlarge

Why The Athabasca Basin?

The Athabasca Basin is home to the world’s largest and highest grade uranium mining and milling operations – including the McArthur River and Cigar Lake uranium mines, as well as the Key Lake and McClean Lake uranium mills. Saskatchewan is also consistently ranked as a top mining jurisdiction to work in globally by the Fraser Institute. Skyharbour holds an extensive portfolio of uranium and thorium exploration projects in the Basin and is well positioned to benefit from improving uranium market fundamentals with 25 projects, ten of which are drill-ready. Skyharbour has acquired from Denison Mines, a large strategic shareholder of the Company, a 100% interest in the Moore Uranium Project which is located 15 kilometres east of Denison's Wheeler River project and 39 kilometres south of Cameco's McArthur River uranium mine.

2012-2022 Southwest Athabasca Basin Uranium Discoveries

- The Arrow discovery made by NexGen Energy (TSX: NXE); now the high grade Arrow deposit

- Patterson Lake South discovery made by Fission Uranium (TSX: FCU); now the high grade Triple R deposit

- Cameco / Orano (formerly AREVA) / Purepoint Uranium's Hook Lake Spitfire Zone high grade discovery

- Three separate major discoveries in a short period of time in this emerging uranium district illustrate high grade nature of mineralization and potential for additional discoveries

- The JR Zone was recently discovered by F3 Uranium (TSX.V: FUU) during a fall 2022 drilling program on the Patterson Lake North "PLN" property

2005-2021 Eastern Flank Athabasca Basin Uranium Discoveries

- Wheeler River's Phoenix and Gryphon Deposits being explored and developed by Denison Mines (TSX: DML); Phoenix deposit contains indicated resources of 70.2M lbs U3O8 at a grade of 19.1% U3O8 and the Gryphon deposit 3 kilometres northwest of Phoenix contains inferred resources of 43M lbs U3O8 at a grade of 2.3% U3O8

- Hathor Exploration which was acquired by Rio Tinto in 2011 explored Roughrider deposit which contains indicated resource of 17.2M lbs U3O8 at a grade of 1.98% U3O8 and inferred resource of 40.7M lbs U3O8 at a grade of 11.2% U3O8

- J-Zone discovery by Fission Uranium and KEPCO; indicated 306,831 tonnes at 1.52% U3O8 (10.2 million lbs) and inferred 138,404 tonnes at 0.90% U3O8 (2.7 million lbs)

- Hurricane Zone high grade discovery 29.9% U3O8 over 7.0 metres in drill hole Q22-040 made by IsoEnergy (TSX-V: ISO) at their Larocque East property

- The majority of the large, high grade uranium deposits and mines are found on the east side of the Basin with the potential for additional discoveries to be made