Moore Lake - Core Project

Moore Uranium Property Highlights:

-

Skyharbour has acquired a 100% interest in the 35,705 hectare (88,191 acres) Moore Uranium Project from Denison Mines, a mature uranium exploration property in the eastern Athabasca Basin near existing infrastructure with known high grade uranium mineralization and significant discovery potential

-

Denison Mines (TSX: DML) (NYSE MKT: DNN) is a large, strategic shareholder of Skyharbour and David Cates, President and CEO on Denison, is on Skyharbour's Board of Directors

-

Moore hosts high grade uranium mineralization at the Main Maverick Zone, which was discovered by JNR Resources in the early 2000's; historical drill results include 4.03% eU3O8 over 10m, including 20% eU3O8 over 1.4m at a depth of 265m in hole ML-61

-

Skyharbour has carried out diamond drill programs over the last few years with several drill holes intersecting high grade uranium mineralization along the 4.7 kilometre long Maverick structural corridor

-

Drill intercepts of high grade, shallow uranium include 20.8% U3O8 over 1.5m at 264m, 9.12% U3O8 over 1.4m at 278m and 5.29% over 2.5m U3O8 at 279m

-

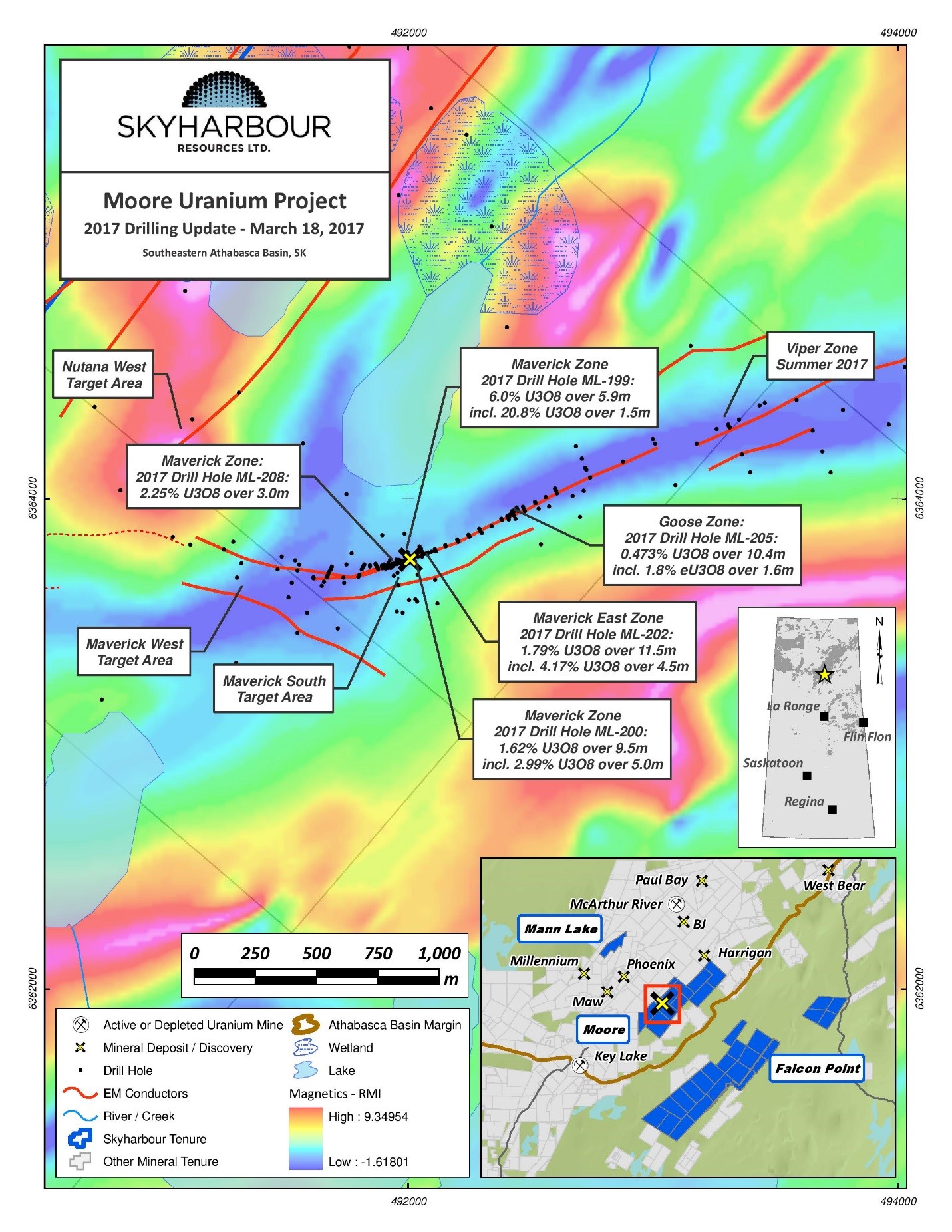

Skyharbour's drill hole ML-199 tested the Main Maverick Zone lens and intersected high grade uranium mineralization containing 6.0% U3O8 over 5.9m at 265 metres depth including 20.8% U3O8 over 1.5m

-

Hole ML-202 from the Maverick East Zone intersected high grade uranium of 1.79% U3O8 over 11.5m at 270m including 4.17% U3O8 over 4.5m and 9.12% U3O8 over 1.4m

-

This is a newly discovered high grade mineralized lens at Maverick East on the Maverick corridor 100 metres from the Main Maverick Zone, and illustrates the strong discovery potential of additional high grade lenses along strike

-

More recently, Skyharbour has identified and refined new targets in the underlying basement rocks using modern exploration and methodologies

-

A drill program in the Fall of 2020 tested both unconformity and basement targets along the high grade Maverick structural corridor

-

Drill hole ML20-09 which returned 0.72% U3O8 over 17.5 metres from 271.5 metres to 289.0 metres, including 1.00% U3O8 over 10.0 metres hosted in the basement, represents the longest continuous drill intercept of uranium mineralization discovered to date at the project

-

The summer/fall 2021 drill program saw 6,598 metres in nineteen diamond drill holes completed with drillhole ML21-03 returning 2.54% U3O8 over 6.0 metres including 6.80% U3O8 over 2.0 metres

-

Of particular interest were underlying basement feeder zones to the unconformity-hosted high grade uranium present along the Maverick corridor; these targets have seen limited historical drill testing

-

In addition to the Maverick Zone, diamond drilling in several other target areas has intersected multiple conductors associated with significant structural disruption, strong alteration and anomalous uranium and pathfinder element concentrations

-

The property has been the subject of extensive exploration with over $45 million in expenditures and over 150,000 metres of diamond drilling in more than 390 drill holes

-

Only 3 kilometres of the total 4.7 kilometre long Maverick corridor has been systematically drill tested leaving strong discovery potential along strike as well as at depth in the underlying basement rocks which have seen limited drill testing historically

-

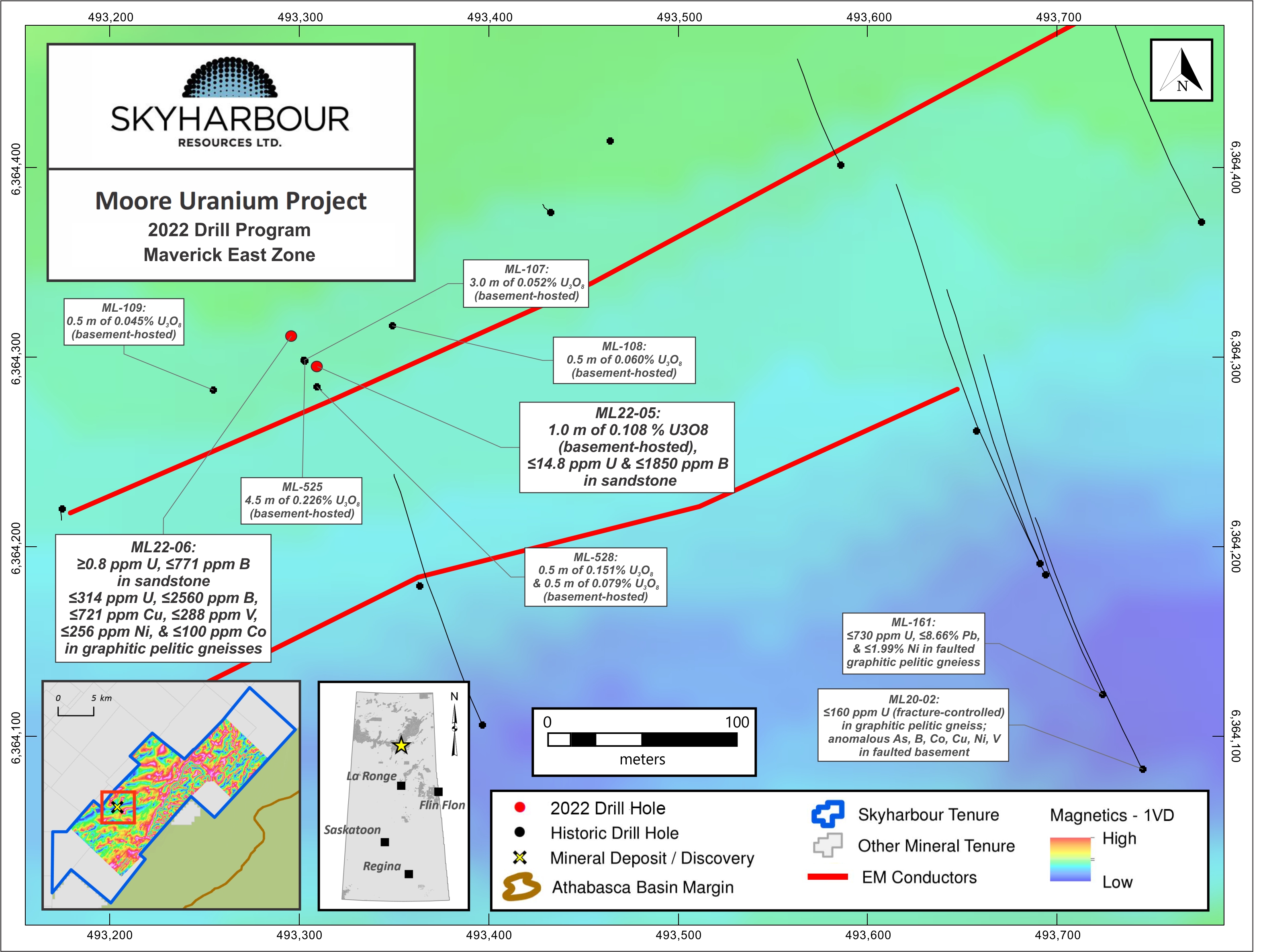

2,467m spring 2022 drilling program recently completed in seven drill holes. Four exploratory holes were drilled at the Grid Nineteen target conductors, two exploratory holes were drilled in the Viper target area, and one hole was drilled at the Maverick East Zone

-

Plans for a 2024 winter drilling program is planned at Moore Lake, consisting of eight to ten diamond drill holes upon the completion of the drilling at the adject Russell Lake project

Moore Uranium Project History and Overview:

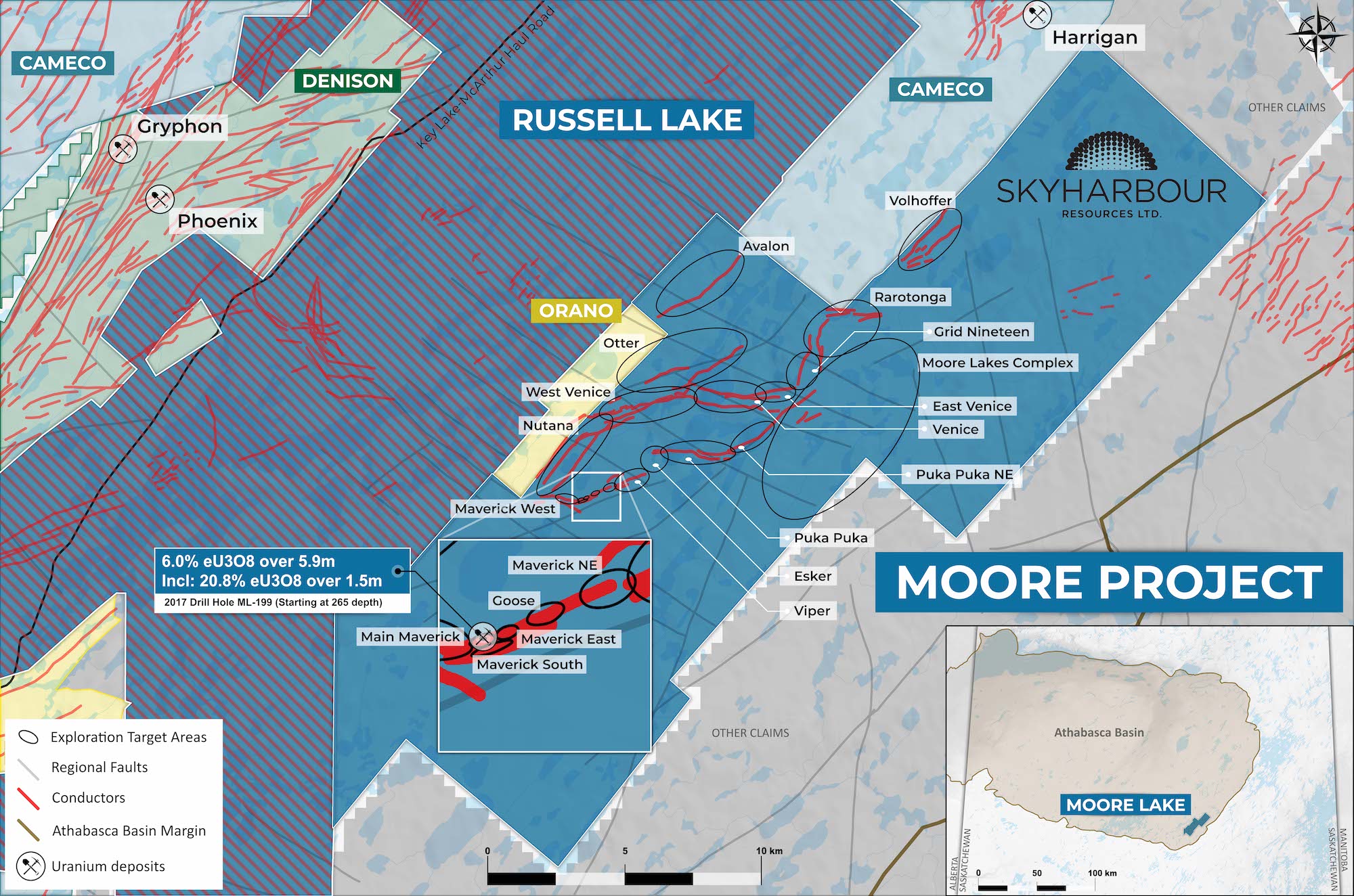

In June 2016, Skyharbour secured an option to acquire Denison Mine's Moore Uranium Project, on the southeastern side of the Athabasca Basin, in northern Saskatchewan and has fulfilled its earn in. The project consists of 12 contiguous claims totalling 35,705 hectares located 42 kilometres northeast of the Key Lake mill, approx. 15 kilometres east of Denison’s Wheeler River project, and 39 kilometres south of Cameco’s McArthur River uranium mine. Unconformity style uranium mineralization was discovered on the Moore Project at the Maverick Zone in April 2001. Historical drill highlights include 4.03% eU3O8 over 10 metres including 20% eU3O8 over 1.4 metres, and in 2017, Skyharbour announced drill results including 6.0% U3O8 over 5.9 metres including 20.8% U3O8 over 1.5 metres at a vertical depth of 265 metres. In addition to the Maverick Zone, the project hosts other mineralized targets with strong discovery potential which the Company plans to test with future drill programs. The project is fully accessible via winter and ice roads which simplifies logistics and lowers costs, with large proportions of the property are accessible in the summer as well.

Moore Uranium Project Claims Map:

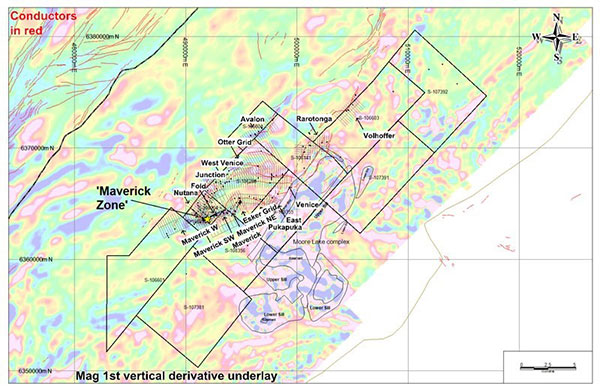

Since 1969, the property has undergone episodic exploration by several companies including Noranda, AGIP, BRINEX, Cogema, Kennecott/JNR Resources and IUC/Denison. In April of 2000 the Maverick Zone was discovered and in the fall of 2003, International Uranium Corporation, who then merged with Denison, optioned 75% of the property from JNR and took over operatorship. Subsequently, Denison acquired the remaining 25% interest from JNR for an undivided 100% in February of 2013, when it acquired all of the outstanding shares of JNR. Exploration programs carried out on the project lands include an assortment of airborne and ground electromagnetic and magnetic surveys, ground gravity, seismic, IP/resistivity and geochemical surveys, mapping, prospecting, lake sediment sampling programs and the drilling of more than 390 diamond drill holes. From mid-2000 onwards, the primary focus of exploration has been the 4.7 kilometre long Maverick structural corridor where pods of high grade unconformity-type uranium mineralization have been intersected. The best intercepts to date were obtained from drill holes testing the southwestern portion of this corridor. The potential of intersecting additional mineralization along this corridor is very good and as such it will continue to be a high priority target area. Also of note is that both basement and unconformity-type uranium mineralization have been intersected in a number of underexplored target areas on the property.

In addition to the Maverick Zone, diamond drilling in several other geophysical target areas, has intersected multiple conductors associated with significant structural disruption, strong alteration and anomalous uranium and pathfinder element concentrations. This bodes well for the possibility of discovering additional high grade uranium zones in these areas.

Moore Uranium Project Geophysics Map:

Skyharbour’s former Head Technical Advisor and Director, Rick Kusmirski commented: “I’ve always considered the Moore Uranium Project to be one of the most geologically prospective exploration projects in the Basin, with the potential to host a sizeable high grade uranium deposit. JNR made the initial high grade discovery at the Maverick Zone and after a number of years we sold the project and company to Denison. I am very excited to get back to work on this project with the Skyharbour team. In addition to the Maverick structural corridor, which still has a number of targets that are untested and require follow-up, there are at least nine other target areas throughout the property that contain well defined and extensive conductive systems. The nominal amount of drilling that was carried out in these areas intersected well defined structures associated with multiple graphitic lithologies. Analysis of the drill core returned highly anomalous geochemistry, including uranium mineralization in seven of the target areas.”

2024 Winter Drill Program:

Skyharbour will conduct a second phase of drilling consisting of 3,000 metres at its high-grade Moore Project upon completion of the drilling at Russell Lake. Skyharbour plans to carry out infill and expansion drilling at the high-grade Maverick Corridor as well as to test several regional targets including the Grid Nineteen target area. This second phase of drilling will total 3,000 metres in eight to ten drill holes.

News Release - January 10, 2024

Skyharbour's Spring 2022 Drill Program:

News Release - October 13, 2022

Drilling on the Moore Uranium Project over the spring of 2022 totalled 2,467 metres in seven diamond drill holes. Four exploratory holes (ML22-01 to -04) were drilled at the Grid Nineteen target conductors, two exploratory holes (ML22-05 and -06) were drilled in the Viper target area, and one hole (ML22-07) was drilled at the Maverick East Zone.

Moore Uranium Project - Viper Drilling:

Future drill programs will continue to test targets identified by modelling down plunge of the Maverick East Zone, targets along the Grid Nineteen conductors where anomalous geochemistry and geology have been identified, and test other regional targets at the project where the geochemistry/pathfinders and geology are strongly indicative of potentially uraniferous mineralizing systems.

Moore Uranium Project - Grid Nineteen Drilling

Terms of the Denison-Skyharbour Option Agreement:

Under the terms of the Option Agreement with Denison, Skyharbour has acquired a 100% interest in the Moore Project having issued 4,500,000 shares and having made a cash payment of CDN $500,000 as well as funding CDN $3,500,000 in exploration expenditures. Skyharbour now has an additional five year period to incur an additional $3,000,000 in exploration expenditures on the project.